How Hard Money Atlanta can Save You Time, Stress, and Money.

Wiki Article

Getting The Hard Money Atlanta To Work

Table of ContentsTop Guidelines Of Hard Money AtlantaThe Facts About Hard Money Atlanta RevealedSee This Report on Hard Money AtlantaThe Hard Money Atlanta Ideas

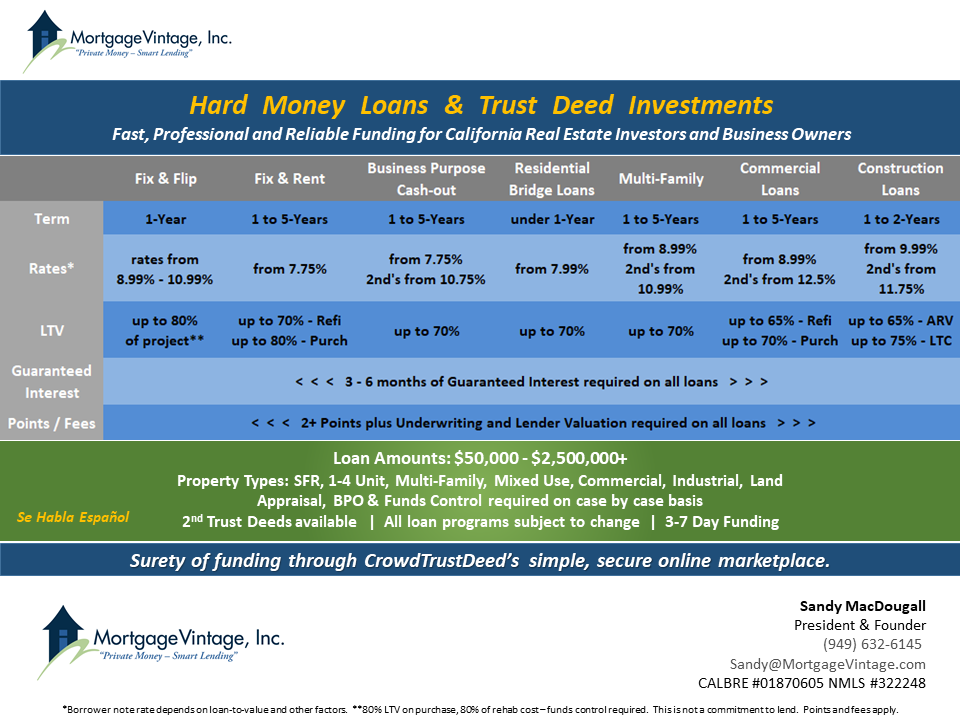

In many locations, rates of interest on tough cash car loans run from 10% to 15%. Furthermore, a consumer might require to pay 3 to 5 factors, based on the overall funding amount, plus any applicable appraisal, inspection, and management costs. Lots of difficult money lenders require interest-only settlements throughout the brief duration of the lending.Hard cash loan providers make their money from the passion, factors, and costs credited the customer. These lending institutions seek to make a quick turn-around on their investment, thus the greater rates of interest and shorter regards to difficult cash financings. A difficult cash financing is a good idea if a customer needs money quickly to buy a property that can be rehabbed as well as flipped, or rehabbed, rented out and re-financed in a relatively short amount of time.

They're also great for investors that do not have a great deal of security; the home itself comes to be the collateral for the finance. Hard money financings, however, are not suitable for traditional property owners wishing to fund a home lasting. They are an useful tool in the financiers toolbelt when it involves leveraging cash to scale their business.

For personal capitalists, the very best part of getting a difficult money financing is that it is simpler than getting a standard home mortgage from a bank. The approval process is normally a lot less extreme. Financial institutions can request for an almost endless series of files as well as take numerous weeks to months to obtain a lending authorized.

Little Known Facts About Hard Money Atlanta.

The major objective is to see to it the borrower has a leave strategy as well as isn't in monetary mess up. Lots of hard cash lenders will certainly work with people that don't have great credit, as this isn't their largest issue - hard money atlanta. The most vital thing tough money lenders will certainly look at is the financial investment residential property itself.They will additionally assess the consumer's scope of job and spending plan to ensure it's sensible. Sometimes, they will quit the process due to the fact that they either believe the residential property is too far gone or the rehabilitation budget is unrealistic. Ultimately, they will examine the BPO or appraisal and also the sales and/or rental compensations to ensure they concur with the examination.

There is one more benefit constructed into this process: You get a second set of eyes on your offer as well as one that is materially spent in the job's end result at that! If a bargain is negative, you can be fairly confident that a hard money loan provider won't touch it. You must never ever make use of that as a hop over to these guys justification to abandon your own due diligence.

The very best location to try to find difficult money loan providers remains in the Larger, Pockets Difficult Money Loan Provider Directory or your local Real Estate Investors Association. Remember, if they've done right by another investor, they are most likely to do right by you.

The Basic Principles Of Hard Money Atlanta

Read on as we talk about tough money financings and why they are such an eye-catching option for fix-and-flip genuine estate investors. One major advantage of tough money for a fix-and-flip financier is leveraging a relied on lender's reputable resources and speed.You can handle tasks incrementally with these strategic fundings that permit you to rehab with simply 10 - 30% down (depending on the loan provider). Difficult cash car loans are normally temporary lendings utilized by genuine estate capitalists to money fix and also flip buildings or various other property financial investment deals. check it out The residential property itself is used as collateral for the financing, as well as the quality of the realty deal is, for that reason, more vital than the consumer's creditworthiness when getting approved for the car loan.

This also suggests that the threat is greater on these finances, so the rate of interest rates are typically higher also. Deal with as well as flip investors pick tough money because the market does not wait. When the chance provides itself, and you prepare to obtain your job into the rehabilitation phase, a hard cash financing obtains you the money straightaway, pending a fair analysis of the service deal.

The Definitive Guide to Hard Money Atlanta

Intent and property documentation includes your comprehensive range of work (SOW) as well as insurance policy. To analyze the residential or commercial property, your loan provider will check out the worth of similar properties in the area and their projections for development. Adhering to a price quote of the property's ARV, they will certainly money an agreed-upon percent of that worth.

Report this wiki page